The call for a differentiated and holistic climate policy

1.1. Differentiate according to dominant replacement technology

FEDIL and its members subscribe to the Paris Agreement. Luxembourg’s industrial community also shares the climate and energy objectives of the EU and those of Luxembourg. It is willing to engage in an energy transition process. The transition’s ultimate goal is the global decarbonisation of all sectors until 2050 through a continuous substitution of fossil-fuel-based, energy-intensive technologies by clean and energy-efficient ones. Such technology change is not new; it is an inherent phenomenon of modern industrial evolution. It occurs whenever a superior technology emerges that has the power to substitute an existing technology and pushes it out of the market.

Knowing that the pace of technology change is different from one sector to the next, smart climate policy can influence the rate of technology change to a certain degree. Despite the most sophisticated climate policy, however, decarbonisation efforts turn out to be a very different challenge depending on the very sector. The main difference comes from whether acknowledged alternative low-emission technologies, including related infrastructures, are available to that sector.

For sectors with ready to use low emission technologies, the energy transition can represent a massive opportunity for innovative businesses. Currently and for the short-term future, the automotive sector is in such a scenario. The right incentives in this sector can significantly accelerate its rate of decarbonisation because the dominant replacement technology seems to be clear, and the infrastructure development is well advanced. We are talking about the battery-powered electric vehicle and the charging infrastructure[1]. A focused climate policy that incentivises R&D and innovation of the related technologies, infrastructure developments, and demand-side promotion motivating buyers to adopt electric vehicles will accelerate decarbonisation.

For most other sectors, however, there is still a high level of uncertainty because, yet, no dominate replacement technology is defined. In these sectors, companies are working simultaneously on multiple low-CO2 technology options to determine the dominate replacement technologies. In Luxembourg, the cement-, metallurgic- and the glass industry are in this situation. For all these energy-intensive sectors’ core processes, the dominant replacement technologies are not yet clear, or they are too immature to deploy on an industrial scale. In this scenario, even the sharpest climate policies are subjected to technological uncertainties in the same way as the industry. Policies can further expect to have a hard time to significantly accelerate the definition of the dominant replacement technology as sound R&D in this stage of high uncertainty tends to be intrinsically slow and time-consuming. Moreover, focused policy actions to accelerate R&D work is much more difficult because efforts must be diluted among multiple technological options that are still in the race. In other words, climate policies must be willing to place a bet on one or more technologies including its corresponding infrastructure investments, and they must be willing to accept the risk of a suboptimal allocation of resources.

The policy implications are clear: Climate objectives, as well as the support measures to reach those objectives, must be differentiated according to whether a sector can rely on a dominant low carbon replacement technology already today. Ignoring this reality is inevitably going to lead to significant disruptions, including carbon- and investment leakage in some of Luxembourg’s most important energy-intensive industrial sectors.

Policymakers who are serious about the climate agenda need to have the courage to share risks with sectors that are still in search for the dominant replacement technology. It is the courage to massively support sectors where decarbonisation implies huge effort in terms of R&D, time, investment and infrastructure development despite a high level of uncertainty. They further need the courage to adapt climate objectives to allow those sectors to profitably operate while they are trying to determine the dominant replacement technologies to manage the transition successfully.

1.2. Towards a holistic approach

The energy transition as tackled by the PNEC and the climate law bill is going to have a fundamental impact on the way our society and economy is organised and run. Across all major sectors of the real economy, the PNEC focuses its efforts to change both: How businesses design, create and offer their products or services, and how consumers allocate their spending on those products and services. As this shift occurs, major elements of our economic system are bound to change: Known value chains and their interactions, related financial and revenue streams, as well as the required resources and skills-sets, are affected. Major changes in these principal elements of the economic system will inevitably have an impact also on the social and welfare system. In other words, the scale of change initiated by the energy transition is a systemic change in modern society. It thus needs to adopt a holistic approach, including all the consequences of its actions on that system.

The PNEC and the climate law bill do not present a holistic approach. Both must review the following points to make sure that the implications of their actions to the current economic and social system are fully understood:

- Public Finance: Climate policy measures that aim to reduce CO2 emissions in the transport sector are massively displacing fuel sales to neighbourhood countries. It will imply a net loss for Luxembourg’s public finance that not even the revenues from the CO2 tax are going to compensate sufficiently. Moreover, the announced subsidies and support measures accompanying the PNEC and the CO2 tax will lead to additional public spending. The impact of the drafted climate policy on public finance is poorly addressed both in the draft PNEC and in the climate law bill. Both describe hardly any countermeasures about how the loss of public finance can be managed.

- Burden Sharing: The PNEC and the proposed policy measures need to review their balance in terms of burden-sharing. A policy that places a large part of the burden on businesses while at the same time relieving civil society of its responsibility endangers the PNEC’s general acceptance among enterprises.

A policy that wishes to influence consumer behaviour in favour of climate protection through new or increased taxes on fossil fuels must refrain from automatic compensations of that same tax-related price signal, except for low revenues. National inflation (IPCN) must thus be measured according to a sustainable product basket to be introduced before the tax mentioned above. The decision not to adapt the IPCN is going to cancel-out the price signals for consumers to change their consumption behaviour. On top, it will make businesses pay twice for climate policies: Once directly via the tax on their emissions and a second time via the salary increases to be paid to their employees triggered by the IPCN.

- Labour and skills: the energy transition shows clear limits to many of today’s industrial sectors. It is not difficult to foresee which industrial activities are destined to shrink in the future. Job losses are thus unavoidable. Policies must prepare and focus on facilitating the transition of the impacted workforce to new and other activities rather than building barriers to conserve jobs that eventually disappear. Much needed are forward-looking economic and labour policies that concentrate on future proof jobs by pushing corresponding investments. Nevertheless, the development and attraction of new sustainable industries may not be enough. Significant efforts must be dedicated to building bridges for economic activities to transform or phased out towards new jobs to be created while greening the industry.

- Option to purchase emission rights: The government should not recklessly discard the option of buying emission rights from other member States to achieve its EU climate targets. History has shown twice to Luxembourg that this instrument can be an effective solution, especially because the country’s small and open economy is widely exposed to external influences when it comes to achieving targets.

- Clever use of the Climate and Energy fund: Ministries in charge of sectoral targets must be given the means allowing them to reach their targets. They also include access for those ministries to the Climate and Energy fund (Kyoto fund) to implement their sector specific measures, such as an incentivizing CO2 tax deduction system, or to finance energy transition projects in the sectors they are responsible of if the Kyoto fund is meant to become the governments main source of finance.

[1] According to the MIT study “Insights into future mobility” from 2019, battery-powered electric vehicle (BEV) may be considered as the transition technology of choice until other technologies such as hydrogen fuel cell electric vehicles may start to become more price competitive. For the time being, it is thus safe to consider BEV as the dominant replacement technology for internal combustion engines.

Objective setting

2.1. Sectoral objectives

The industrial community supports the sectoral approach presented in the bill for climate protection. The bill breaks down national targets into sectoral targets giving responsibilities to the different actors in society and the economy to contribute to fighting climate change. Also, the mechanism that foresees balancing over- and under-achievements of targets between sectors make sense to reach targets cost-efficiently.

The sectors defined in the bill for climate protection are, however, differently defined from the sectors one finds in the National Energy and Climate Plan (NECP). Even though, this incoherence in determining the sectors may result from methodological constrains imposed by the European Commissions for the elaboration of the NECP, it tends to increase complexity and reduces transparency. Once adopted by the EU Commission, FEDIL recommends consolidating the reduction objectives and trajectories according to the sectoral definitions as suggested in the bill for climate protection for the further use on a national level.

2.2. Industry’s emission reduction objectives

The NECP quantifies emission reduction targets in terms of tonnes of greenhouse gas (GHG) to be reduced between 2020 and 2030 base on the value of 2005. This data is, however, hard to understand as it does not inform about the source of the initial data, nor does it show what methods, assumptions or hypothesis were used to calculate projections and emission reduction trajectories. It is vital for the buy-in of sectoral actors who are solicited to contribute to reaching national climate targets to understand how their sectoral targets were calculated.

Concerning GHG emission targets for the industrial sector: the NECP does not show on what sources the initial GHG emission data from 2005 (“Inventar”) is based on, what kind of industrial emissions it includes and how the different phases[1] of the ETS have been factored in. The same goes for the target data (“Zielszenario”) used for GHG reductions. Primary attention attracts the emissions target data suggested for the industry in 2020, which already represents a -62.8% reduction versus 2005, while the government has an overall reduction target of -55% until 2030. Such a high reduction versus 2005 can most probably be attributed to the ETS systems’ change of scope along the way. However, the plan does not offer explanations about how it dealt with that change of scope to determine or adjust its projections.

Furthermore, it is unclear how the starting values of 2020 for the period 2021 to 2030 were identified and how reduction trajectories were determined. EU regulation[2] requires determining the national emission values based on average emissions between 2016 and 2018; the industry’s starting values do not seem to correspond to such an average calculation.

The accuracy of the projected emission reduction target values as described in the PNEC today for the end of 2020 need to be verified once national statistics report about the real emissions. As the 2020 value represents the starting value for the 2021 to 2030 reduction trajectories, their accuracy is critical. If measured emission statistics reveal significant discrepancies from the sectoral emission projections, the government must allow a review of the trajectories as well as of the target values that must be achieved by 2030 in the sectors.

2.3. Industry’s energy efficiency (EE) objectives

After decades of energy efficiency (EE) efforts in the industry, it has become far from trivial to identify and exploit yet further profitable efficiency potentials. Most energy efficiency gains in the industry are small, incremental and have long payback times which does not make them particularly attractive to implement. They are typically realised thanks to a technology switch, where a next-generation technology brings the EE gain. A good example is the switch from traditional illumination technologies to highly efficient LED lights.

When determining EE objectives for the industrial sector, this paper thus suggests sticking to realistically available EE potentials, which can be realised cost-effectively and in a profitable way. The NECP does not explain on what bases it determines the EE objectives it suggests for the industry.

In Luxembourg’s industry, it is safe to assume that the most substantial energy efficiency potentials are tied to half a dozen company’s core processes from the energy-intensive sectors of steel, glass, cement, or aluminium production. Next-generation technology switches or upgrades also realise energy efficiency gains in these sectors. Knowing, however, that the investment cycles in these industries are between 15-25 years, it is evident that significant energy efficiency gains cannot be expected to be delivered continuously. It might, therefore, be worth considering those energy-intensive companies apart from the rest of the industry and adapting the industry’s overall EE objectives accordingly.

In a nutshell, it is crucial to identify for all objectives in the NECP data that reflects real-world situations. Only realistic emission data and EE potentials can ultimately yield achievable target values. Wishful climate targets bear a considerable risk to hamper Luxembourg’s economy to develop competitively as they impose constraints the industry cannot match.

[1] The number of companies participating in ETS in 2005, the year of reference is different from the number of companies participating in it in 2020 – how has this difference been considered in determining non-ETS targets from national statistics?

[2] REGULATION (EU) 2018/842 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 30 May 2018 on binding annual greenhouse gas emission reductions by Member States from 2021 to 2030 contributing to climate action to meet commitments under the Paris Agreement and amending Regulation (EU) No 525/2013

Impact assessment of industry-specific measures

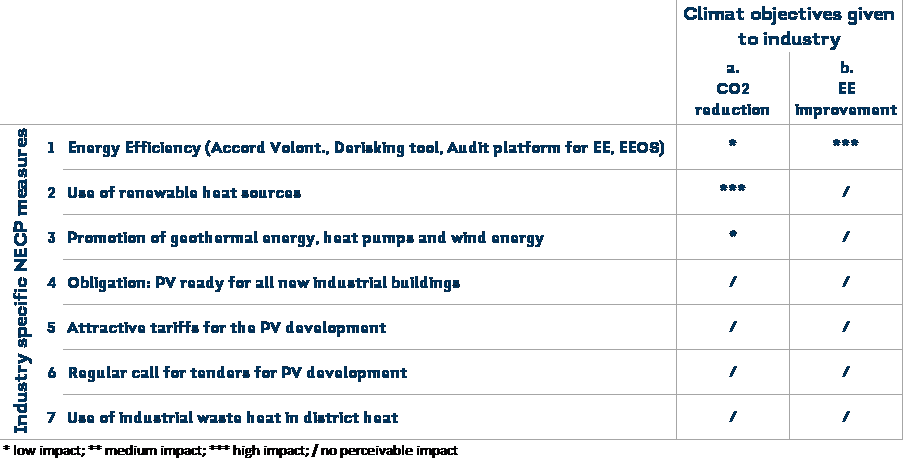

The National Energy and Climate Plan (NECP) suggests several industry–specific measures to help the industry reach its emission reduction and energy efficiency objectives.

Table 1 lists the seven industry-specific measures found in the NECP. It opposes them to the two main climate objectives given to the industry: (a.) CO2 reduction and (b.) energy efficiency (EE) improvement. The table assesses how the measures contribute to reaching those objectives.

The following paragraphs explain the industry’s evaluation of the suggested measures:

1.Energy efficiency measures:

- The impact of energy efficiency gains on CO2 reduction is low as most non-capital-intensive, and profitable energy efficiency potentials lie in small electric powered industrial side-processes rather than in major CO2 emitting core processes. They can be realised mostly by switching to a new, more efficient technology generation.

- Energy efficiency measures have obviously an impact on energy efficiency objectives. For measures to be realised, they must, however, focus on improving the business case of technology switches. The importance of a solid business case grows with the capital intensity of a technology switch. In general, the EE improvement, as well as a related CO2 reduction, increase with the capital intensity of the technology switch. A well-designed De-risking tool might be able to contribute a great deal to improve EE improvement’s business cases.

Unfortunately, the NECP gives little to no details about the design of the suggested EE instruments. It merely announces to deepen the Voluntary Agreement (VA) and to widen its scope to include a larger number of companies with less energy consumption. FEDIL welcomes the approach to try motivating a larger number of companies to realise energy efficiency gains. At the same time, the federation believes that the best way to do so is by creating a different type of VA that considers the specificities of those companies.

Trying to attract a larger population of less energy-intensive companies to adhere to the VA under its current design might be difficult. The current VA’s design is optimised to motivate large energy consumers to reduce their energy needs. The level of benefits is in direct relation to the volume of their initial energy consumption. To access the benefits of the scheme, adherents must be willing to invest in energy audits, training and knowledge exchange sessions. For less prominent energy consumers, however, benefits that are based only on the level of energy consumption may not be able to weigh-out the investments required to adhere to the scheme.

Concerning the Energy Efficiency Obligation Scheme (EEOS), FEDIL issued a specific paper[1], including design proposals for a post–2020 period of the EEOS. This paper is based on the lessons learned from the first phase 2015-2020. It is annexed to the present note.

Furthermore, FEDIL members are concerned about confidentiality issues related to the instrument called Audit Platform. Even though the industrial community agrees about the usefulness of such a platform to accelerate energy efficiency, data protection and non-disclosure of business-related information must be respected.

2. Use of renewable heat sources:

-

- The use of renewable heat sources has a high impact on reducing industrial CO2 emissions, especially if large, centralised industrial fossil fuel-run heat production units can be substituted by renewable heat sources while using the best available technology. The government must thus welcome, support and promote any industry-driven initiatives aiming at implementing, for example, biogas and biomass units by swift authorisation procedures.

This NECP measure’s effectiveness, however, much depends on the availability of affordable renewable heat sources on the market. For sizeable industrial heat production units, a steady supply of biomass, biogas or renewable electricity-based hydrogen or e-fuels are needed. The NECP’s projections about the additional supply of biomass and biogas[2] for heat production in 2030 compared to 202o are however mostly insufficient. If only the small community of non-ETS Accord Volontaire companies (data of 2017) would exclusively access all of the additional supply, it could still only cover about 85% of their need to substitute fossil fuels in heat applications.

Knowing that the real need for biogas and biomass for heat comes from a much larger community of consumers – including the entire industrial community, ETS and non-ETS companies, the residential, commercial and public sector – it is clear that the projections for renewable heat sources must be reviewed for this measure to be practical.

Moreover, the PNEC restricts the origin of biomass that can be used in Luxembourg to the regions of Saarland, Lorraine and Luxembourg. Such a restriction is difficult to comprehend for the industrial community as in a free economy, politics should, in principle, refrain from restricting markets and supply chains arbitrarily.

This is even truer within the present context, where politics sets CO2 reduction targets to the industry whose achievement directly depend on whether companies can switch to biomass as an alternative fuel.

Restricting the supply of biomass to a limited area has an inevitable impact on its price. It is safe to assume that companies residing in the Saar and Lorraine regions are also switching to biomass as they are trying to reach their respective national climate objectives. We can thus expect a significant increase in demand for biomass driving its price to new unknown highs. As a result, biomass may even be eliminated as the last competitively priced renewable fuel for heat production in many industries knowing that the supply of biogas, hydrogen or other synthetic green gases is considered widely insufficient and too expensive. Under such conditions, FEDIL critically challenges the government’s CO2 reduction targets set for the industry.

The NECP further limits its considerations about renewable heat sources to biogas or biomass; it does not even mention the production and use of hydrogen or renewable e-fuels as a possibility.

The switch to and use of biogas, quality biomass, hydrogen or green e-fuels has a higher cost than further using natural gas whose price is currently highly competitive. The government must, therefore, commit to keeping its price components in renewable heat sources low as well as its feed-in tariffs attractive. In other words, grid costs, taxes and other levies on biogas and biomass must be held at a minimum and evolve transparently and predictably. The same applies to the price of renewable electricity as it would be needed in huge volumes to produce hydrogen or green e-fuels.

2. The use of renewable heat sources does not have any contribution to improve energy efficiency (EE) in the industry. On the contrary, EE might even suffer temporarily. A switch towards a renewable heat source and/or new technologies able to process the latter need recalibration to find new process optimums. It also needs time for new alternative technologies to become as energy efficient as the mature ones now in use.

3. Promotion of geothermal energy, heat pumps and wind energy:

-

- In an industrial context, geothermal energy and heat pumps can contribute to reducing CO2 emissions which originate from heating industrial buildings. The impact of this measure to contribute to the industry’s CO2 emissions objectives is, however, low, as heat pump and geothermal technologies cannot deliver the high-temperature ranges frequently required in industrial processes.

- No noticeable impact can be expected from this measure on improving energy efficiency. The deployment of renewable technologies does not contribute to consuming less energy.

4. – 7. The remaining four measures:

These measures undoubtedly contribute to the NECP’s renewable energy objectives, but they do not help the industry to reach its goals. It is therefore difficult to understand why they have been suggested as measures to support the industry specifically.

Moreover, measure four (4.) which obliges new industrial buildings to be PV ready must be considered a burden rather than support. Specialists from the construction sector estimate that it increases the material costs for such buildings by 7%-13% at the expense of every new industrial development project.

All in all, only two out of seven measures listed explicitly in the NECP for the industry have a high impact in supporting the industry to reach its climate objectives. Measure four (4.) even imposes additional costs to the industry without yielding any direct contribution to its climate goals.

For the two effective measures (1. and 2.), little detail is provided about their design. For example, all the instruments suggested to increase EE, such as the Derisking Tool, the Energy Efficiency Platform, Accord Volontaire or the EEOS must be presented in more detail. FEDIL is glad to contribute to conceptualising those tools.

The industry is ready to contribute with its share to reach national climate objectives. It expects, however, a broader portfolio of effective measures for the support. National climate objectives must be accompanied by a set of practical measures enabling the industry to achieve the objectives realistically. An unbalance between objectives and supporting measures weigh heavily on the industry’s competitiveness, ultimately hampering its economic development and leading to carbon leakage. The next chapter includes several propositions on how to strengthen the industry-specific measures in the PNEC.

[1] https://www.fedil.lu/fr/positions/energy-efficiency-obligation-scheme-eeos/

[2] Decentral and grid connected biogas, see synthesis document page 5

Propositions about how to strengthen the industry-specific climate measures

4.1. Review Voluntary Agreement’s benefits system to serve the PNEC

The following paragraphs describe how changes in the Voluntary Agreement (VA) could leverage the measures number 4., 6. and 7. assessed in the previous chapter and thus making them useful as climate measures for the industry.

Changes in the benefit schemes of the VA as well as in what it acknowledges as energy efficiency could substantially increase the industry’s contribution to reaching the national climate objectives as described in the NECP. This paper sees two direct levers of change:

- Photovoltaics: A VA that would recognise auto produced photovoltaic power (PV) as a form of saved energy or avoided emissions for the industry may incentivise more companies to engage in renewable electricity production to realise their VA objectives.

- District heat: A VA that would recognise district heat provided by the industry to heat residential and commercial buildings as a form of energy efficiency or avoided emissions for the industry would also be able to increase the number of such projects.

In both cases, the NECP can take great advantage from such an initiative. It incentivises a more significant number of companies and projects that can contribute to climate objectives including those that might otherwise not have been able to do so because no competitive dominant replacement technology is yet available for their activity.

4.2. Deploy renewable electricity via PPAs as a source for decarbonisation

Surprisingly the NECP does not mention renewable electricity as a powerful source for the decarbonisation of the industry. On the contrary, it expects the industrial consumption of electric power to decrease in the future. It is, however, safe to assume that significant decarbonisation efforts also rely on the direct or indirect electrification of industrial processes. Moreover, the increasing digitalisation across all business sectors, as well as the electrification of the transport and mobility sectors, massively drive demand for low-carbon electricity. Consequently, the whole economy’s need for low-carbon power increases, and it is going to do so across a broad spectrum of sectors, surpassing the ones identified today as electricity-intensive.

This paper expects that competitively priced; low-carbon electric power represents a fundamental prerequisite to allow businesses to comply with ever stringent climate policies focused on decarbonising the economy. Considering the scenario of rapidly rising demand for renewable electricity, the NECP’s projections for renewable electricity supply are too conservative.

Luxembourg’s geographic and climate situation is not optimal to produce large volumes of competitively priced renewable electricity reliably. To provide the amounts of renewable electricity necessary to decarbonise the economy, the government must thus negotiate cross-border renewable power purchase agreements (PPAs).

For more extensive PPAs to materialise, regulators must work on three major points:

- Even though global renewable PPAs have seen dramatic growth in the past few years, the reality is that available volumes in renewable PPAs in the EU stay limited and are increasing only slowly[1]. Some member states, however, seem to be more successful than others in implementing renewable PPAs. Framework conditions incentivising companies to conclude renewable PPAs may be helpful to increase demand and stimulate in this way an increase of supply.

For Luxembourg’s commercial and industrial consumers to sign renewable PPAs, international barriers must be removed, and governmental backing and assistance might be required as those PPAs would certainly be cross-border agreements.

- Most energy-intensive companies operating in Luxembourg do not source electricity on a national level to supply their local facilities. They purchase electricity on a cross-border, regional level and for multiple facilities. It is therefore essential to make renewable PPAs available to the industry on a regional rather than on a local level. Furthermore, experience shows that physical shifting of the energy sources as required in direct PPAs is generally tricky and that large scale PPAs are hard to finance. Luxembourg’s industry thus suggests focussing on creating framework conditions that promote cross-border regional and small scale virtual It is, however, crucial that companies will be allowed to claim the renewable electricity acquired from such regional PPAs for their local facility’s environmental performance, avoiding acceptance issues of international guarantees of origin.

- Even though electricity sourced from renewable PPAs is free from CO2, the electricity price of such PPA, which is in general in-line with market prices, still includes CO2 surcharges arising from EU ETS, also referred to as indirect carbon costs. As such, the industry is unable to influence its electricity expenses by the amount of renewable power it consumes, since the electricity price on the market is indexed to the marginal price. Efforts to increase the volume of renewable PPAs contracted by the industry must thus allow the sector to shed CO2 surcharges if they source renewable electricity. This is especially true for energy-intensive industries to prevent carbon leakage.

4.3. Carbon capture and re-use

Furthermore, the NECP does not include carbon capture technologies such as CCS[2] or CCU[3] as an option to reach climate objectives in the short term. Today, these technologies may not represent a long-term solution for the decarbonisation of industry. Yet, their temporary deployment in energy-intensive industries such as steel, cement or glass production is essential to help these industries to overcome the transition period until low carbon technologies are available and competitive. This paper thus urges the government not to discard CCS and CCU as a technological option per se.

Also, the production of hydrogen as an alternative low carbon fuel is for the moment only possible via CCS or CCU. As there is not enough excess renewable electricity available in the grid to produce green hydrogen, hydrogen will either be produced from electricity with embedded CO2 or via gas natural reforming. Currently, over 90% of hydrogen is produced via natural gas reforming. Natural gas contains methane (CH4). This methane is used to produce hydrogen via thermal processes, such as steam-methane reformation and partial oxidation. These processes, however, release CO2, that must be captured if hydrogen is supposed to substitute fossil fuels.

[1] Source: Schneider Electric, 2018: Around Europe in 5 Minutes: Top Markets for Renewable PPAs

[2] Carbon capture and storage

[3] Carbon capture and utilisation

Impact assessment of the horizontal measure: CO2 tax

5.1. Scope of the CO2 tax

The CO2 tax’ scope, as described in the PNEC, covers the non-ETS sector. In Luxembourg, the concerned industrial sector is composed mainly out of small and medium-sized manufacturing companies (SMEs). Those companies continue to operate from Luxembourg, despite Luxembourg’s high wages and already restrictive environmental legislation. They manage to do so thanks to high-level and continuous efforts in innovation, market specialisation and productivity. It is safe to say that many of those companies count globally amount the best in their sector, and in Luxembourg, they are known as jewels of the local industrial sector. Even though FEDIL acknowledges the climate urgency, it regrets that the CO2 tax will put an additional burden on those companies.

FEDIL welcomes that the CO2 tax does not affect the ETS sector. The ETS sector is already incentivised by the price of the tradable emissions allowances on the EU level. Adding another national price for CO2 emissions on top of ETS would undoubtedly be perceived as uncoherent with EU policy and unfriendly to business. Also, such a policy would be little effective to fight climate change as it would encourage the concerned, mostly large multinational companies to accelerate disinvestments and relocate operations outside of the EU.

5.2. Penalties for doing business in Luxembourg

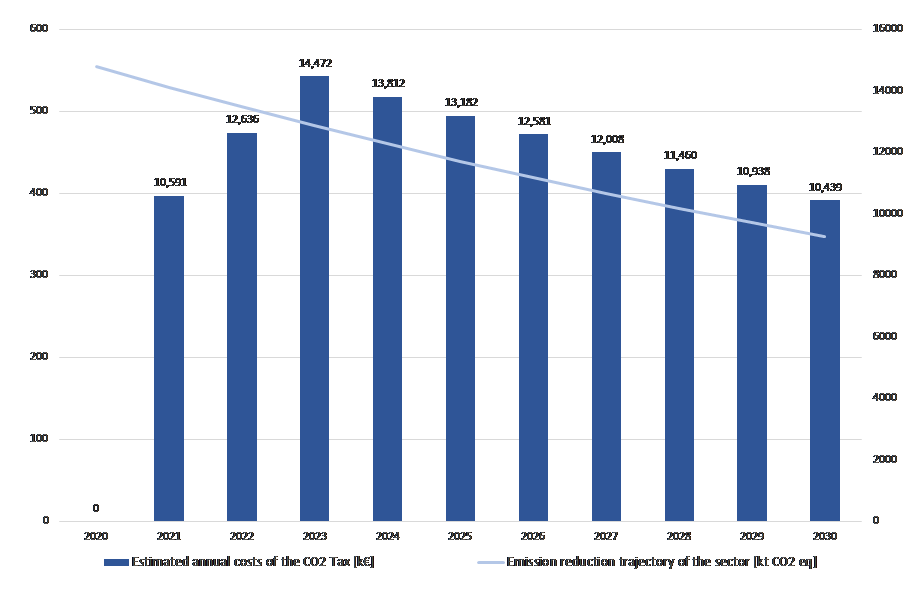

According to a FEDIL simulation, the total annual cost impact for all non-ETS companies from the sector labelled “Energy and manufacturing industry, and construction” according to the bill of the climate legislation, is estimated at around 10.5 million Euros in 2021, reaching a maximum of about 14.4 Mio Euros in 2023, see Figure 1.

One might be inclined to say that an annual burden of 10-14 million Euros for the whole sector has only a little impact on the individual company. Data of the Accord Volontaire which is considered representative for the industrial non-ETS community shows, however, that the population of non-ETS companies follows the distribution pattern of the long tail when it comes to CO2 emissions: It is composed by a handful of large emitters followed by a vast number of small to insignificant emitters, the long tail of the emission profile. Research on the data mentioned above shows that the top five emitters bear around 10% of the sector’s total tax burden. The tax significantly hits those companies which represent at the same time some of the most value-adding and prominent industrial companies of Luxembourg’s non-ETS sector.

Figure 1 shows the year on year cost simulation for all non-ETS companies in this sector. It represents a best-case scenario, assuming that companies can reduce their emissions according to the NECP, i.e. by -55% versus 2005 in a linear reduction pathway. In other words, Figure 1 shows the minimal costs imposed by the tax, and this means, in turn, that every different outcome hits companies even harder.

Figure 1 furthermore illustrates two critical effects of the tax:

- Over ten years the tax levies a total amount of over 122 million Euros. This amount is not available to companies for investments into energy transition-, growth- or business development projects. Due to the long-tail pattern of the non-ETS industrial sector’s emission profile, top emitters miss substantial volumes of investment funds while they would most need them to prepare the energy transition.

- Even if companies fully reach their CO2 reduction targets in 2030, they can only reduce their tax burden to the level of 2021. In other words, even fully complying with the climate objectives still does not liberate from the tax.

The two points above demonstrate that the tax, as it is described today in the NECP, penalises companies for doing business in Luxembourg. Nevertheless, this penalty represents for the time being a relatively small, negative incentive to stimulate a significant number of companies to reduce their carbon footprint. A higher penalty, in turn, bears the risks to influence companies to reduce or relocate current production capacities as well as future investments abroad. When it comes to competitiveness issues, government representatives refer to CO2 taxes in other EU countries. But some of these tax systems foresee partial or total exemptions for several industry sectors.

FEDIL believes that a positive, rather than a relatively low, negative tax incentive can stimulate a more significant number of companies to shift investments in favour of carbon neutrality. The next chapter presents some proposals for such a tax design.

CO2 tax: from a penalty to an investment incentive

6.1. Two crucial design principles for a CO2 tax

In principle, prices have the economic function of allocating limited resources to their most efficient use. Along this line, a tax for the emission of CO2 modifies the price ratio between low-CO2 and CO2-intensive production processes and tends to shift resource allocations towards alternative, more CO2 efficient production technologies.

For such a substituting investment to happen despite a relatively low price-signal by the CO2 tax, two preconditions must be fulfilled simultaneously: Firstly, a competitively priced, alternative low-carbon technology must be available on the market, and secondly, the investment into the alternative technology must allow reducing the tax burden while simultaneously reducing future tax exposure.

According to those two preconditions, a CO2 tax that aims at incentivising low-carbon technology investments in the industry must include the following two design principles:

- Allow a CO2 tax deduction of all investments that help to achieve emission reduction targets;

- Conditionally exempt sectors from the tax when no alternative low CO2 technologies are available.

Based on those two principles, the following paragraph describes how a CO2 tax might be designed concretely to help companies in different situations to accelerate their transition towards carbon neutrality.

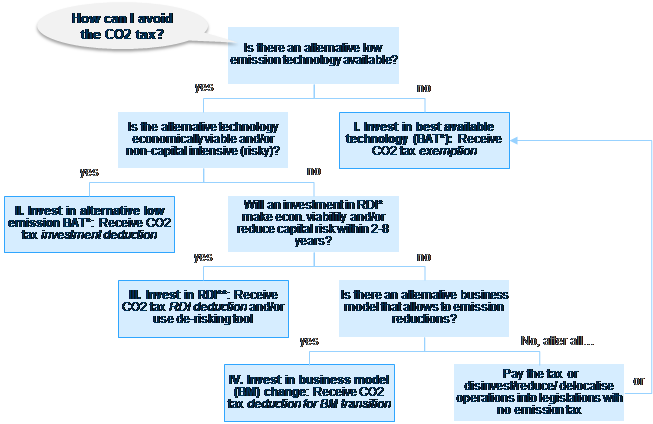

6.2. A CO2 tax that accelerates the transition

Four scenarios of incentives

Following the two design principles described in 6.1, Figure 2 shows four scenarios of how a cleverly defined CO2 tax can positively incentivise investments into reducing CO2 emissions. It includes four different types of decision scenarios a company must make when trying to optimise resource allocation in the face of a CO2 tax.

This approach calls upon a company’s ambition to avoid the CO2 tax by investing into an option that reduces its carbon emission rather than paying the tax fee, and at the same time, reducing future tax expose. This double benefit must be offered at different stages of the investment process described in Figure 2 so that companies with varying levels of tax exposure and access to substitution technologies can react in favour of emission reductions:

- Invest in best available technology: Companies choosing this investment option are running processes where there is no alternative low emission technology readily available on the market. The only option to reduce emissions for those companies would equal to reduce production output.

Typically, this is the case for companies operating industrial processes that rely on very high temperatures over persistent periods. In Luxembourg’s non-ETS industrial sectors, only a handful of companies are in this case. Examples are found in steel and aluminium related production and the operation of high-temperature regeneration and pre-sulphating treatment processes.

For such companies that do not have viable alternative technology options to reduce their CO2 emission significantly, it must be the tax’ goal to motivate them to upgrade their processes continuously. As a reference for upgrades, this paper suggests using performance levels of the best available techniques (BAT) according to EU documentation. BAT refers to the available techniques which are the best for preventing or minimising emissions and impacts on the environment. Companies having installed the BAT must then be fully exempt from the tax to prevent carbon leakage.

This approach calls for a threshold, fixing a company’s annual tax-exempt emission volumes that are independent of its yearly production fluctuation. This paper suggests setting for each company a reference baseline for the period 2021-2030. At constant production capacity, this baseline may be calculated by determining the emissions that the average annual production volumes of the years 2018, 2019 and 2020 would have emitted if produced by the current BAT. This baseline would then represent the reference for permissible yearly emissions. It must be undercut by measured emissions to be eligible for a full exemption of the CO2 taxes. In the case the production capacity changes, it may be factored-in according to the methods[1] used by the ETS industry to determine a new company-specific baseline.

Considering that the approach to receive a tax exemption in this scenario seems straight forward, it may be considered to significantly increase the price signal of the tax in case of non-compliance. A stronger price signal incentivises companies more quickly to opt for an investment to install the BAT.

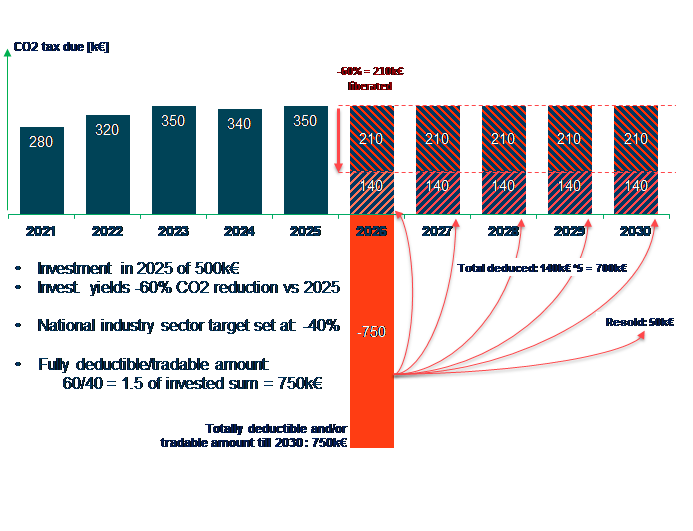

- Invest in alternative low-emission best available techniques (BAT): This scenario assumes that proven, alternative low-emission technologies are available on the market and that their economic viability is similar to traditional technologies. A company can, therefore, be incentivised to invest in the best available technique (BAT), i.e. the technology with the highest emission reduction potential, by allowing it to deduce the amount of the investment from the due CO2 tax.

This paper suggests determining the permissible tax deduction, based on the initial investment, as a proportional ratio to its achieved emission reduction level when compared to the industry’s national reduction objective. For example, if the industry’s national emission reduction objective would be at -40% between 2020 and 2030, and if a company’s investment would achieve a -60% emission reduction from one year to the next: the investment could be deduced and, or tradable (reselling) to other companies at 1.5 times (=60/40). The deduction can be made annually from the remaining due CO2 tax amounts, starting from the moment of the demonstrated reduced emission until the end of the tax period in 2030 (see Figure 3).

This design turns the negative incentive of a tax into a double benefit for businesses. A Co2 reducing investment triggers the first benefit. It will entitle the investing company to reduce its due tax amount by the same percentage as the reduced tonnes of CO2 emissions achieved thanks to the investment. This first benefit will then be doubled by the possibility to deduce from the remaining due tax, an amount determined as a percentage of the initial investment. This percentage is the ratio of the achieved emission reduction level to the industry’s national reduction objective. Tax deductions can start as soon as the investment shows its emission reduction effect and until the end of 2030. Limiting the deductible time-period to 2030 incentivises companies to place their investments toward the beginning of the tax period 2021-2030 to maximise their deduction return.

Tradability of all achieved emission reductions further incentivises companies to reduce more emissions than the industry’s national reduction targets. Tradability in this context does not refer to full auctioning as in the EU ETS. Here, tradability refers to the simple option for companies to resell granted emission rights to other companies operating in Luxembourg. Reselling promotes the concept of cost-effectiveness in CO2 reduction, knowing that the investment per emission reduction volume is different from one sector to the next.

The example described above and shown in Figure 3 represents an extreme case. It was chosen deliberately to illustrate all the design elements of our proposal. We expect that real-world CO2 reductions in the industry are going to be less pronounced because it is difficult to reduce CO2 emissions significantly, even with significant investments.

- Invest in RDI (Research, development and innovation): This scenario applies in case alternative low-emission technologies are not yet fully mature. Companies willing to invest in further developing such technologies’ emission reduction potentials should also be allowed to deduce these investments from the CO2 tax burden. Such investments typically target technology demonstration projects where the expected emission reduction potentials can be quantified with reasonable accuracy.

In terms of the European Union’s technology readiness levels (TRL), only projects with a TRL level of seven an above should be considered for a “system prototype demonstration in [its] operational environment”. For such projects, the level of tax deduction can be determined proportionally according to the demonstrator’s CO2 reduction performance, increased by an R&D risk factor which depends on the TLR level. The proportion ratio can be determined by applying the same method as described in paragraph II.

- Invest in business model change: Companies shift to adapting their business model if no technology-based option allows avoiding the CO2 tax. To lower their carbon footprint, companies can look for example, for business models based on circularity concepts, reuse or recycling.

Eligibility of tax deduction

It seems essential to focus the eligibility for the CO2 tax exemptions on a limited number of significant energy consumers from the non-ETS sector. For their identification, it makes much sense to stick to the companies adhering to the current voluntary agreement, which comprises the most energy-intensive companies of the non-ETS sectors. Currently, the voluntary agreement includes around 50 companies. As a result of the long-tail profile of the non-ETS industrial sector (see chapter 5.2), the tax does not profoundly impact all of those 50 companies.

The structures and competencies gathered around the Voluntary Agreement seem to represent an ideal platform for the identification, certification and the management of the CO2 tax exemption scheme as suggested above. The certifying body of that platform can draw from a wide range of methods and knowledge when it comes to performing energy audits and certifications. Such competencies are necessary to run the tax exemption scheme, for example, to assess best available techniques (BAT) or to establish the level of emission reductions that an investment in a low emission technology yields.

Furthermore, existing energy consumption thresholds used in the Voluntary Agreement (VA) such as the 4100Mwh annual consumption of natural gas to determine the eligibility for the current VA’s tariff ‘C’ could be used to identify the companies eligible for the tax deduction or exemption. This threshold would considerably reduce the number of eligible companies.

[1] See: Guidance on allocation methodologies, Guidance Document n°2 on the harmonized free allocation methodology for the EU-ETS post 2012, European Commission, DG Climate Action, 2011

Managing the transition towards a carbon-neutral industry

7.1. Embrace all flexibility options

This paper is confident that the relevant NECP measures, as described above, can contribute to achieving the industry’s climate targets. The measures are, however, mainly based on the assumption of an economic status quo focusing on today’s industrial base. Little attention is paid on how additional emissions shall be managed. Additional emissions may originate from growth and extension projects of the existing industrial base but also from new industrial implementation projects. After all, an accomplished climate policy can only be one that succeeds to boost industrial activities in Luxembourg while making it sustainable.

For the energy transition to succeed, it is, however, crucial to attract new companies and businesses to Luxembourg that correspond to the sustainable vision of the country’s economy. New industrial implementation and extension projects will most probably be picked and authorised accordingly. Nevertheless, their implementation will not abruptly improve Luxembourg’s energy profile. On the contrary, in the short term, they will inflate the national energy profile as they co-exist with the current industrial base during the transition phase.

The challenge of climate change mitigation can be described as threefold from an economic and political view: (1) Managing the energy transition of the economy successfully, (2) achieving the EU climate targets while (3) promoting continuous economic growth. It is a huge challenge and only leaves little flexibility. Luxembourg must, therefore, embrace all remaining flexibility options, including the possibility of acquiring emission quotas from other EU countries to achieve EU climate targets. It must also embrace all technological options, including carbon capture and storage/utilisation. Rejecting those options will dramatically and unnecessarily reduce Luxembourg’s flexibility when compared to other EU economies.

7.2. Strengthen economic transformation strategies

Luxembourg’s and the EU’s climate policies are about to fundamentally transform the way of living and working, of producing and consuming. The societal, as well as economic rules, are being rewritten in a true Schumpeterian creative destruction. Therefore, some sectors are condemned to shrink and perish and others, new ones emerge, flourish and strive.

Despite this distinct outlook towards a future with higher than usual economic change and uncertainty, Luxembourg’s National Energy and Climate Plan (NECP) does not show much reflection about what industrial-economic transformation strategy the countries should adopt. Instead, the NECP opted for a rather business-as-usual, “more of the same” approach, suggesting to develop green finance further and attracting green start-ups. No specific new industrial business opportunity fields seem to have been analysed or identified. No new niches or specialisation fields have been detected to exploit for the industry.

The NECP must further clarify what transition enabling priorities it wishes to set to help the industry manage the transition successfully. The NECP does not mention any critical enabling infrastructure projects, key transformation technologies such as batteries or hydrogen, or priority fields in industrial research and development.

More reflection also seems to be necessary about how to handle stranded assets that would result from the energy transition or how they might be transformed into value-adding assets again. The most prominent example here is the decreasing importance of gas consumption and its impact on the national gas grid. Unanswered questions include whether the gas grid is decommissioned faster? Who pays for it if there are less and less connected users, or under what conditions it may be worthwhile upgrading to be used as a hydrogen distribution infrastructure?

All in all, the NECP must review and strengthen its strategic approach about how to explore and develop future industrial business opportunities for Luxembourg in the light of climate change mitigation policies.